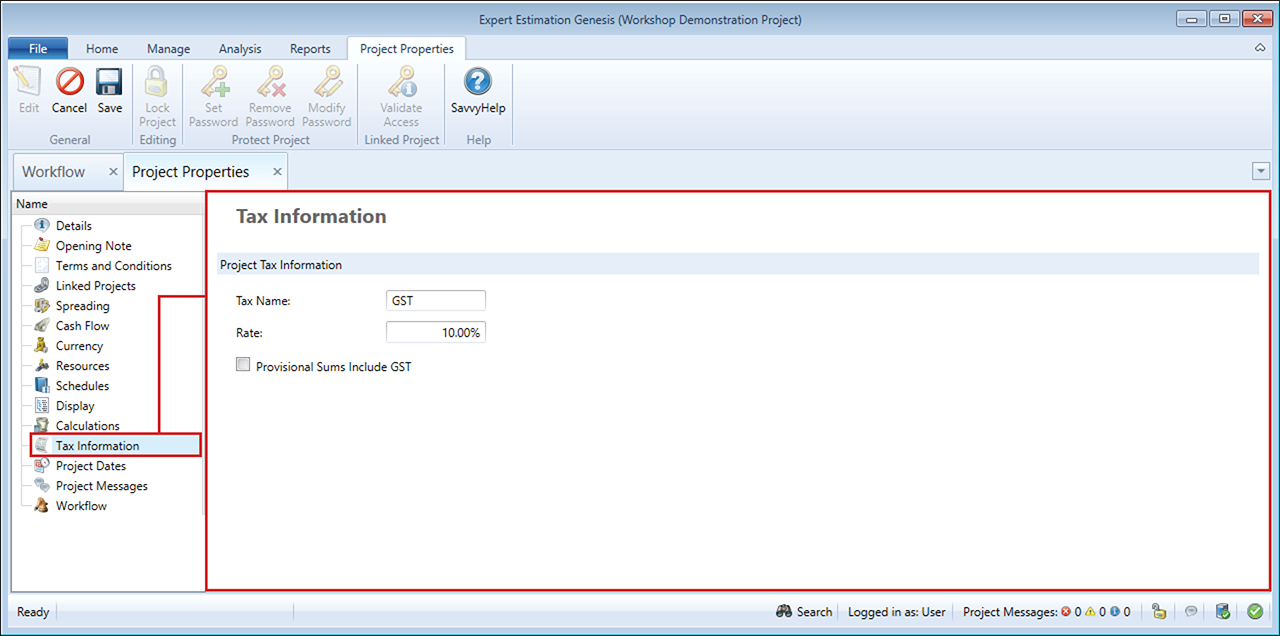

Project Properties – Tax Information

Tax Information includes a range of options for incorporating a general tax or levy across the values of your project. This ultimately provides a clearer understanding of the tax included in the work performed through the project.

To change the information in this section, click the Edit button ![]() in the ribbon menu.

in the ribbon menu.

Project Properties window – Tax Information

PROJECT TAX INFORMATION

|

OPTION |

DESCRIPTION |

|---|---|

|

Tax Name |

The text entered here will be displayed as the identifier for the sales tax that will be applied to the project. Example: GST (Goods and Services Tax). |

|

Rate |

Specifies the percentage used when calculating the total tax amount for the project. |

|

Provisional Sums Include |

Allows you to choose whether the value of a Provisional Sum Item is inclusive or exclusive of tax and is reflected in the Project Summary window. Example: With the checkbox enabled, the Provisional Sum item of 1,100 will display as 1,000 (excluding sales tax) in the Project Summary window. If not enabled, the Project Summary will display as 1,100 (including sales tax). |

ADDITIONAL INFORMATION

The values generated by the Sales Tax will be displayed:

- in the Project Summary as a lump sum figure

- in the Spread Results window on a per item basis in the Tax Amount column, Tax Inclusive Sell Rate and Sell Total columns

- optionally in the Submission Schedule Report, by setting formatting options to include Tax in the Sell Rate and Sell Total columns